do nonprofits pay taxes on rental income

The nonprofit generates income by conducting charity dinners raffles and fundraisers. Generally the first 1000 of unrelated income is not.

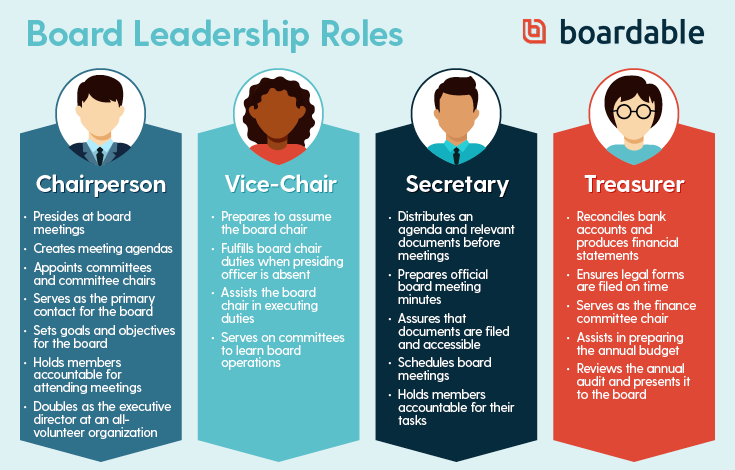

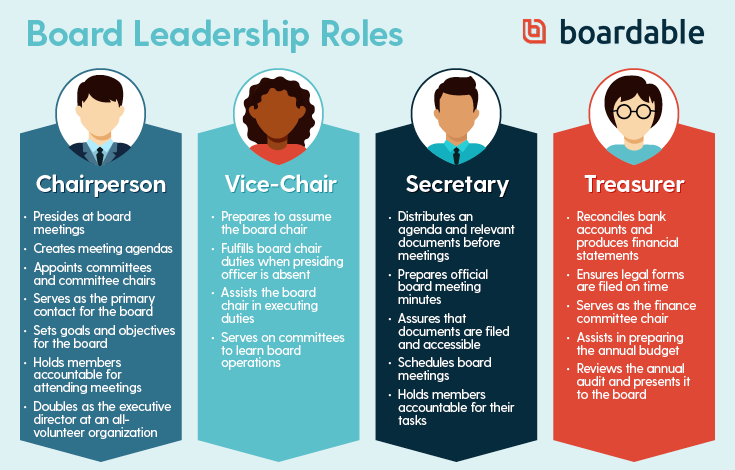

Board Member Responsibilities Roles A Nonprofit S Guide

If your community has vending machines in various places income earned from those is also considered non-exempt.

. Rental property owners can. Because churches operate to serve peoples spiritual needs foster a sense of community and undertake charity they are tax-exempt and allowed to accept tax-free donations. It may be a great way to generate needed income from an underutilized asset.

And while churches are not allowed to turn a profit. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the performance by the organization of its exempt function. Tax Exempt and Government Entities EXEMPT ORGANIZATIONS Tax Guide for Churches Religious Organizations 501c3 Publication 1828 Rev.

That means your HOA must only pay taxes on non-exempt income. The short answer is that rental income is taxed as ordinary income. RAB 2016-18 Sales and Use Tax in the Construction Industry.

Under UK law this obliges UK lettings agents to withhold basic-rate tax due on rental income before it is paid to a UK landlord who lives overseas. There are certain circumstances however they may need to make payments. Which Taxes Might a Nonprofit Pay.

It is a myth that a nonprofit cannot earn a profit. Unrelated business income is typically derived from nonmembers with certain modifications see section IRC 512 a. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

Published on September 4 2014. Some examples of non-exempt income include rental income and dividends. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

There are clear rules as well as several exceptions to. But if yours does 1 it should not be too substantial and 2 it could be taxable despite your tax-exempt status. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption. You are considered a non-resident landlord. You use Form 990-T for your tax return.

However not all rental income is subject to unrelated business income. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. If youre in the 22 marginal tax bracket and have 5000 in rental income to report youll pay 1100.

The amount of tax youll have to pay on your rental income depends on your top tax bracket. However member dues to 501 c 10 organizations go toward social and recreational purposes and not toward benefits for. The nonprofit could properly use the income it generates from these activities to pay operating expenses and employee salaries.

Rental income from real property is taxable. For the most part nonprofits are exempt from most individual and corporate taxes. 8-2015 Catalog Number 21096G Department of the Treasury Internal Revenue Service wwwirsgov.

Any gain allocated to the unrelated business purpose is taxable. Any nonprofit that hires employees will also. It may also trigger a tax liability that could consume that new found income.

However theres more to the story. This article contains some basic advice to consider before you foray into using your property for rental profit. Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits.

For example if your top bracket is 24 and your annual rental profit is 4168 youll owe 1000 in income tax. The nonprofit wont have to pay taxes on any profits it receives because the activities that generated the profits were directly. One source of UBI is rental income.

An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. A nonprofit that uses the property for a mix of related and unrelated purposes has to allocate gain from the sale between the two. If the nonprofit uses the property for an unrelated business it pays tax as described in Form 598.

A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code. This guide is for you if you represent an organization that is.

Sometimes nonprofits make money in ways that arent related to their nonprofit purposes. If you expect to owe at least 1000 in income tax on your profit you are supposed to prepay these taxes to the IRS during the year.

To Buy Or To Rent Evaluating The Right Path For Your Non Profit

Non Profit Budget Spreadsheet Budget Spreadsheet Budgeting Spreadsheet Template

The Nonprofit Sector In Brief Visual Ly

Back To Basics Nonprofit Statement Of Financial Position Altruic Advisors

Grant Proposal Budget Template Grant Proposal Budget Template Grant Writing

Know These Costs Before You Start Your Nonprofit In 2021 Non Profit Startup Funding Grant Writing

Pin By Jason Ritter On Quick Saves Internal Revenue Service Tax Forms Fillable Forms

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Our 2013 Rental Profit Loss Statement Schedule E Http Www Rentalrealities Com 2013 Profitloss Sta Profit And Loss Statement Good Essay Bookkeeping Business

12 Tips For Growing Your Nonprofit Email List Nonprofit Emails Nonprofit Email Marketing Infographic Marketing

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping Chart Of Accounts Accounting Downloadable Resume Template

Yukon S Non Profit Sector Is Booming Is That A Good Thing Cbc News

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Credit Card Statement Tax Forms

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Pin By Letter Writing Tips On Fundraising Letters Business Letter Sample Fundraising Letter Letter Example